2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

2013 Revenue Cycle Management Perception

Providers' Wishlist: Integration, Single-Source, Reform

Providers are looking at their revenue cycle management (RCM) more holistically as we enter a more patient-centric environment in healthcare. RCM integration with both inpatient EMR and ambulatory EMR/patient accounting (PA) is at the forefront of their minds as most look to establish an enterprise-wise revenue cycle strategy that supports today’s value-based models of care including things like episode-of-care billing, family billing, and bundled payments. KLAS interviewed 118 providers for this perception study to shine a light on providers’ RCM needs and strategies, the perceptions and mindshare of vendors, and what factors are driving providers’ replacement decisions.

2013 REVENUE CYCLE PERCEPTION

Providers' Wish List: Integration, Single Source, Reform

Report Author: Lois Krotz

Providers are looking at their revenue cycle management (RCM) more holistically as we enter a more patient-centric environment in healthcare. RCM integration with both inpatient EMR and ambulatory EMR/patient accounting (PA) is at the forefront of their minds as most look to establish an enterprise-wise revenue cycle strategy that supports today’s value-based models of care including things like episode-of-care billing, family billing, and bundled payments. KLAS interviewed 118 providers for this perception study to shine a light on providers’ RCM needs and strategies, the perceptions and mindshare of vendors, and what factors are driving providers’

replacement decisions.

WORTH KNOWING

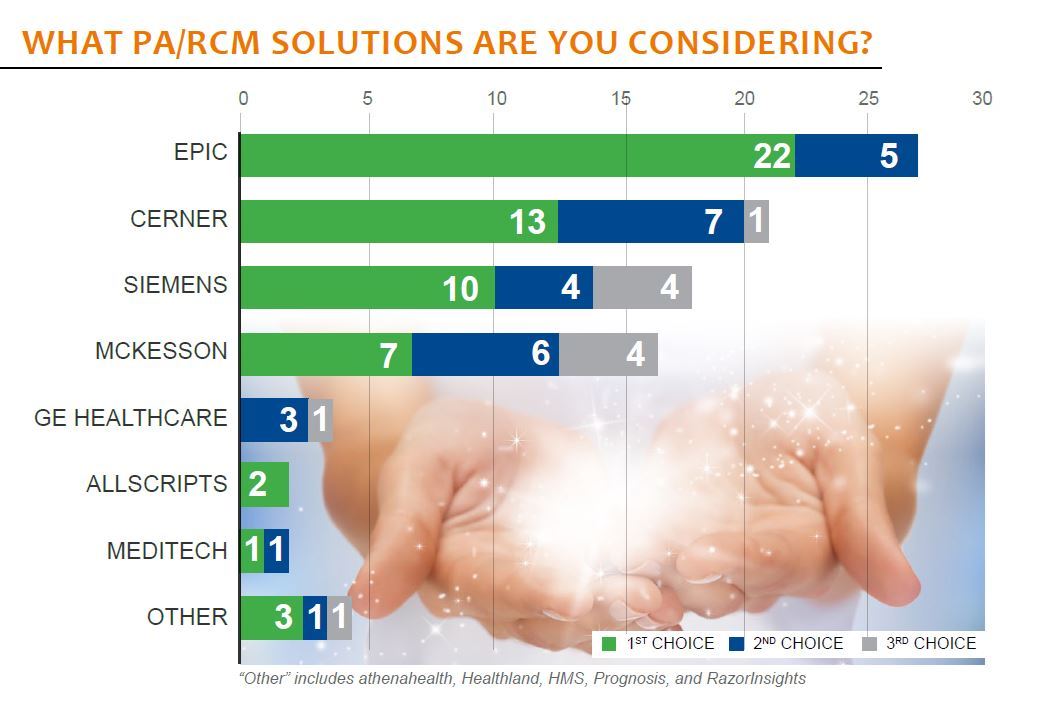

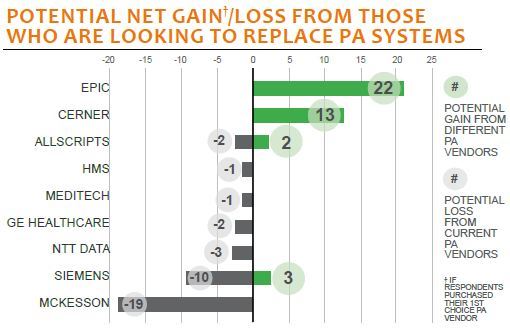

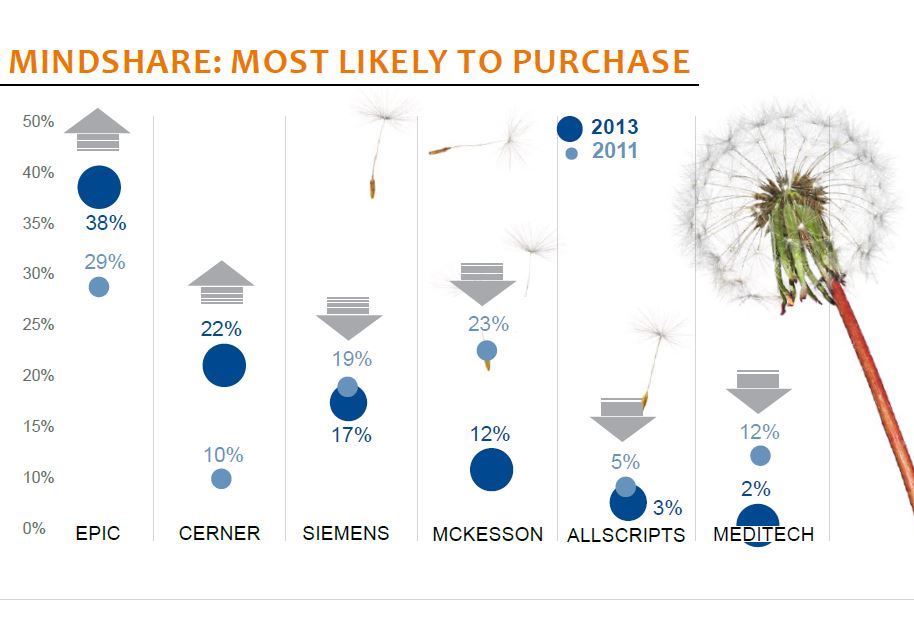

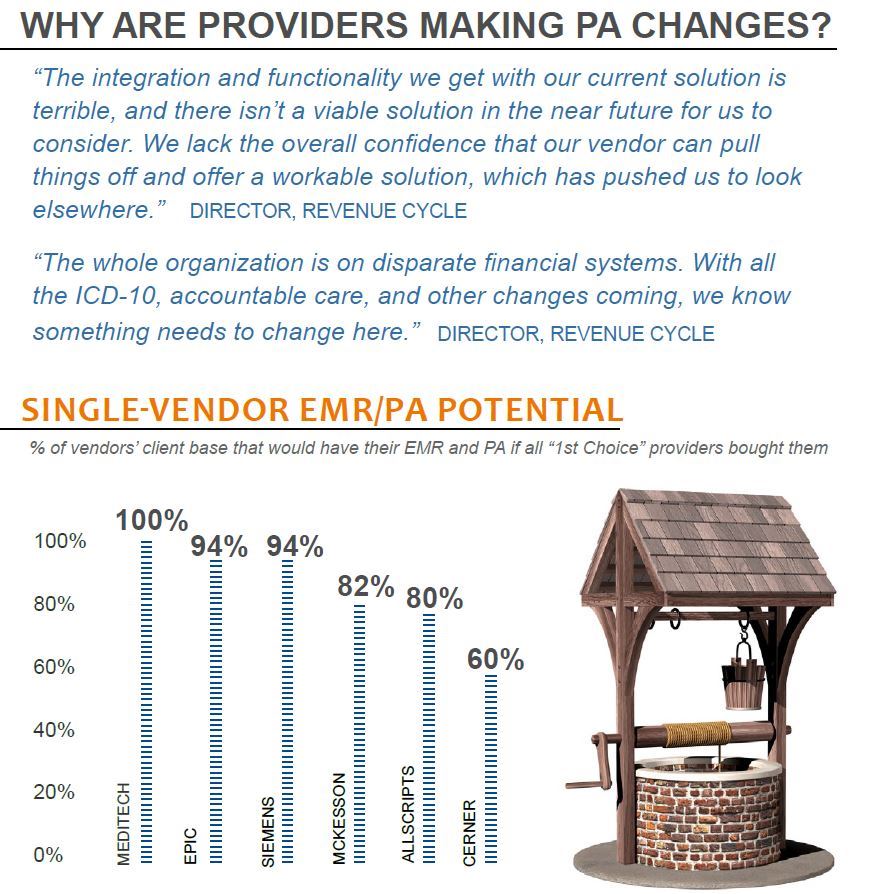

CLINICAL INTEGRATION DRIVES MARKET BUYING DECISIONS, MINDSHARE IS FOR CERNER AND EPIC. EMR/PA integration was the most frequently mentioned decision factor by providers (mentioned by 78%) in this report looking to change their PA system. While all are not integrated, 55% in this study have a single inpatient EMR/PA vendor; that rises to 80% when including the providers moving to preferred choices for a new RCM. As in 2011, Epic topped this year’s RCM consideration list because providers desire integration. Cerner was second in mindshare for similar reasons, but there is still hesitation from their client base about implementing Cerner’s PA.

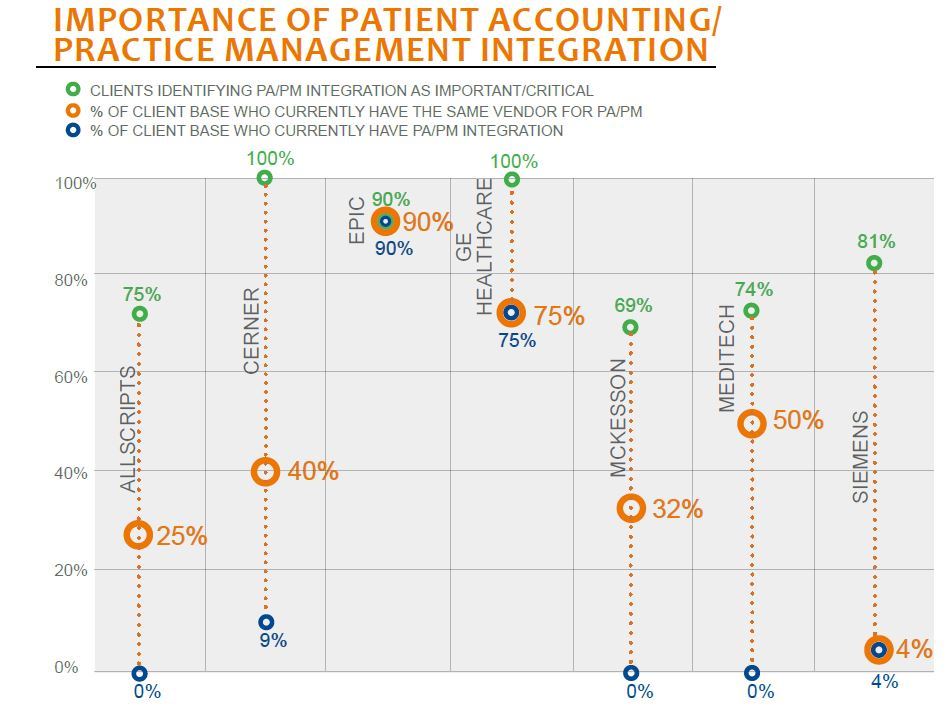

PATIENT ACCOUNTING/PATIENT MANAGEMENT INTEGRATION IS CRITICAL—FEW HAVE IT. Seventy-seven percent of providers believe PA and practice management (PM) integration is important and critical to their revenue cycle environment, but only 14% have it. Cerner, Epic, GE, and Siemens all have integrated PA/PM solutions, but adoption levels and experience vary: Epic’s offering was first to the market and they have the most widespread adoption (90% of clients); GE is second (75% of clients) but with far fewer clients than Epic; Cerner and Siemens have far lower adoption rates. LSS is not integrated but rather is tightly interfaced with MEDITECH, with high satisfaction. McKesson and Allscripts don’t currently have integrated PA/ PM offerings.

BEST-OF-BREED MARKET IS SHRINKING; SIEMENS TOP PROSPECTIVE BEST-OF-BREED VENDOR. One of five providers in this study plan to stay best of breed, with Siemens receiving the most considerations, driven by newer technology and workflow engine. Epic is not historically considered a best-of-breed PA vendor; however, two Cerner EMR clients with no plans to change their EMR listed Epic as their leading PA candidate. GE’s considerations came from providers attracted to their integrated PA/PM and strong bundled payment solution. McKesson has virtually no mindshare from non-McKesson EHR clients.

BOTTOM LINE ON VENDORS

ALLSCRIPTS: No PA/PM integration, while integrated EMR/PA solution is being offered. Several clients looking at them for single-vendor solution, but small mindshare otherwise.

CERNER: After reputation of weak RCM, market confidence in their PA is growing, though some clinical clients are still hesitant. Low current EMR/PA integration (16% of clients) due to clinical clients on other PA systems, but number two in mindshare at 22% of considerations (grew by 12% since 2011).

EPIC: Most-considered vendor for RCM, driven by clinical growth. Highest PA/PM integration ratio among customers as well as having the most large clients with this integration. A few clients question vendor technology development.

GE HEALTHCARE: Praised by clients for acute/ambulatory RCM integration. Does not currently offer inpatient EMR to new clients. According to this research not considered by any providers as first choice for new PA solution; however, some have included GE for consideration in part because of their PA/PM integration.

MCKESSON: Providers look at them for cost/value, integration, and vendor partnership. The announcement that Paragon is their go-forward solution is driving many of their legacy best-of-breed PA (STAR/Series/HealthQuest) customers to look elsewhere. Has highest increase in clients looking to leave. All looking to move are legacy clients. Mindshare dropped from 23% to 12%.

MEDITECH: Strong EMR/PA integration. Three platforms; older customer base. MAGIC clients see value in moving to 6.0, but C/S clients generally don’t. Very tight interface with LSS. Has largest percentage of clients saying PA is meeting needs. Small mindshare outside of client base.

SIEMENS: Leading best-of-breed option due to strong workflow engine and new technology platform. Lowest satisfaction scores of any PA vendor due to perceived lack of expertise to help customers obtain system’s full value. Has a big gap in percentage of clients with PA/PM integration (4%) versus those wanting it (81%).

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.