2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Ultrasound 2014

Saving Time and Money with Workflow Automation

With constant budget and reimbursement issues and under pressure to improve outcomes, healthcare organizations are using more ultrasound technology that saves them time and money. One lead sonographer noted, “Every minute we save is a minute we can use for another patient.” Providers want to know which ultrasound vendors are delivering the best value and time-savings. Where are the time-savings coming from and what new technologies are making a difference? KLAS spoke with 178 providers to find out.

WORTH KNOWING

GE AND PHILIPS TOP-TIER PERFORMERS:

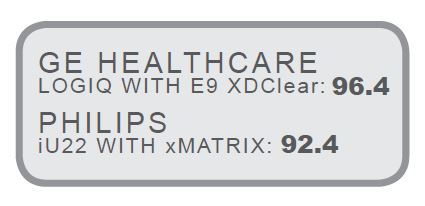

GE's LOGIQ E9 earned the top spot. Its overall score improved over the past year due to providers who were happier with both the scanner's reliability and GE's account management. The Philips iU22, a steady top performer, is virtually tied with GE in this study.

SIEMENS AND TOSHIBA LAGGING:

Toshiba’s Aplio 500 went from first to third in performance over the last two years. Siemens’ customers noted the vendor’s efforts to improve the S2000; however, it too is trailing. Provider satisfaction with the Aplio 500’s functionality dropped dramatically, as did satisfaction with Toshiba’s account management. The bar has been raised for Toshiba as other vendors continue to enhance their workflow solutions. The perception is that Toshiba is falling behind.

GE CUSTOMERS REPORT BIGGEST TIME-SAVINGS DUE TO AUTOMATED WORKFLOW:

GE customers save the most time across all scan types, saving an average of almost seven minutes per scan. Philips, Toshiba, and Siemens customers save just over five minutes per scan. Customers across all vendors save the most time on abdominal scans, but a higher percentage of GE customers reported time-savings for this procedure than did other vendor customers. While only a handful of Philips customers noted time-savings for extremity scans, they saved a lot.

SIEMENS ACUSON S3000 MAKING A SPLASH:

According to a small number of initial users, the S3000 is hitting it out of the park. In reliability, an area where the S2000 initially struggled, the S3000 is solid. S3000 users also rave about image quality: “The best feature, I think, is a new, higher-frequency, curved-array transducer. We generally use curved array for abdominal, pelvic, and OB work, but because it is high frequency, the resolution is much better. . . . We do a lot of pediatric work with the S3000, and the images are dramatically different with that system.”

IS THE PRICE RIGHT?

GE has a reputation for having a higher price point, even with current customers. However, GE has been more aggressive with pricing lately and came in at the lowest average price per unit in this report. Based on information from those who opted to report pricing, Philips is the most costly, and their customers noted that extra charges for service on top of the initial purchase price were an annoyance. However, providers praised Philips’ technology and noted that it is still worth the money. Toshiba is, on average, the second most-expensive option, and several providers felt they are not getting their money’s worth because the technology is not up to the same standards as that of GE or Philips. Siemens is slightly more expensive than GE, and because of reliability challenges that plagued the initial rollout of the S2000, some customers still feel they are not getting their money’s worth. Several Siemens customers mentioned being able to trade in their S2000 for an S3000, and those customers were pleased with that arrangement.

VENDORS

GE HEALTHCARE

Top performer. Providers praise the Scan Assistant tools and the ergonomic features such as ability to easily raise and lower the monitor. GE less costly on average. XDClear has additional functionality and excellent image resolution. The six providers who rated it gave average score of 96 out of 100. Some regional variance in service—customers in the Southeast and Northeast not as happy as those in the Central or Western regions. A couple of providers noted poor quality of refurbished probes.

PHILIPS

Top-tier performer. Organ-identification tool saves time. Noticeable time-savings for vascular and extremity scans. Automation tools and touch-screen user interface very intuitive. Most expensive on average. Those using xMatrix probe very satisfied on average, though room to improve image quality. Early adopters of Philips’ new EPIQ platform report software glitches, resulting in less satisfaction for EPIQ customers than iU22 customers.

SIEMENS

Siemens lands fourth out of four. Users report good time-savings with breast imaging. Some like the automated protocols, but others say S2000 is complex, overengineered compared to GE and Philips units. Some lingering glitches from initial S2000 rollout. Early adopters of the S3000 report improved image resolution, deeper penetration, better ergonomics, though at a higher price.

TOSHIBA

Ranked third, with a large drop over the last year. Almost five points behind Philips. Weakest performance in workflow automation. Biggest time-savings in OB/GYN scans, but lagging behind other vendors in time saved with vascular/echo and extremity scans. Service and support lagging; over 20% said they would not buy again. Reported to be most expensive after Philips; however, a couple of providers mentioned an extended warranty option as adding some value.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.