2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Community Hospital CIS Market Share 2012

Small Hospitals, Big Changes

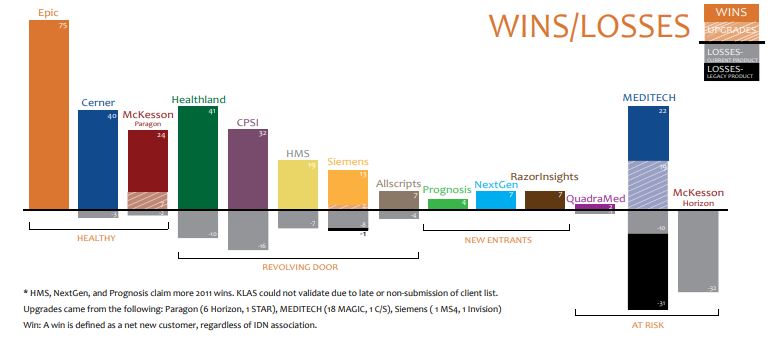

The year 2011 saw incredible churn in the community hospital EMR market. Whether it was smaller hospitals buying for the first time, health systems and consolidation driving single-vendor strategies, or hospitals replacing outdated or failed investments, over 300 hospitals under 200 beds changed or replaced their hospital HIS in 2011. With all this activity, however, are some vendors getting left behind? Is your hospital partnering with a vendor that is not keeping up?

Key Findings

One in Three dissatisfied: There is a significant amount of dissatisfaction and churn in the community hospital market. Almost one in three customers who have gone live in the past 12 months feels they made the wrong decision, reporting they would not buy the product again. While vendor performance is not a key focus of this research, Healthland, Cerner, CPSI, and MEDITECH all have a significant number of unsatisfied newly live customers. For more information on performance data, see the upcoming KLAS 2013 Community Performance report.

Newer-Entry Players Gain Traction: There has been a significant jump in the number of hospitals adopting lesser-known vendor solutions such as NextGen, Prognosis, and RazorInsights. With many more-established players, including Cerner, struggling to consistently deliver well, the door has been opened to these new entrants.

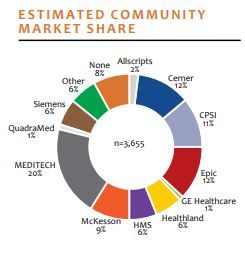

Market Consolidation: Economic forces continue to push smaller hospitals into IDN relationships in order to survive. This continuing trend is resulting in greater displacement of smaller-hospital CIS solutions, such as Healthland and CPSI, for larger-hospital systems, such as Epic and Cerner.

What Does the Future Look Like?

Legacy Solutions are at Risk: As providers gravitate toward newer technology solutions, legacy vendors who don’t innovate can expect to lose market share.

Integration will be King: With MU and the push for ACO, providers will demand integrated inpatient and outpatient solutions that serve the entire healthcare continuum.

Consolidation: Expect to see future losses for small-hospital vendors as standalone hospitals affiliate with IDNs and deploy partner solutions.

Q&A

Q: What are my peers buying?

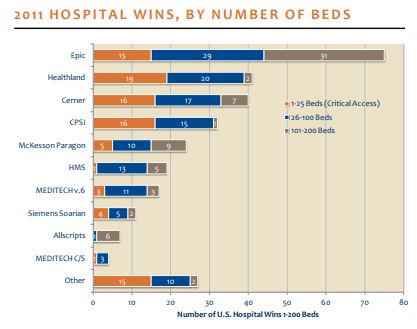

1-25 Beds: CPSI owns the market share for critical access hospitals, with Healthland being a distant second place. Just fewer than 50% of new sales for both vendors came from these hospitals. MEDITECH also has a large presence here, and Cerner continues to gain share as well, primarily through hosting. Each of these vendors has demonstrated the ability to get their smallest customers to meaningful use (MU) Stage 1. All other vendors have some presence in the 1–25 bed market but generally have greater market share with larger hospitals.

26-100 Beds: Epic, Healthland, Cerner, CPSI, MEDITECH, HMS, and Paragon (in that order) all had over 10 wins in 2011 for this bed size. This is the crossroads where both larger- and smaller-hospital CIS products converge to compete for market share.

101-200 Beds: This is now a replacement market, as the vast majority have already selected but not necessarily deployed an EMR. Epic, McKesson Paragon, and Cerner have the greatest impact in this space and are also relatively newer technologies. Epic had the most wins (31) in this area, more than three times any other vendor.

Q: Who can get me to MU Stages 1 and 2 and beyond?

A: MU Stage 1 requirements have proven to be a fairly low bar as every CIS vendor has successfully demonstrated the ability to achieve Stage 1. KLAS’ Meaningful Use Attestation 2012: Early Birds Take Flight report states that providers from all sizes of organizations are confident that their current CIS vendor will get them through MU Stages 2 and 3. Regardless, decision makers must be mindful that Stage 2 requirements will be increasingly more complex and should vet their vendors with both MU Stage 2 and longer-term objectives in mind.

Q: Bottom lines: How healthy is my vendor?

Healthy Vendors –are demonstrating strong growth and are not carrying the baggage of legacy technology

- Epic: Has the most wins (75), and had no losses in 2011. KLAS verified 9 standalone hospitals ranging from 18 to 147 beds that have contracted with Epic in 2011 via larger otherwise unaffiliated organizations. While Epic does not actively sell to the community market in most instances, their Community Connect initiative does support the process for smaller hospitals to implement Epic via hosting arrangements through larger Epic customers.

- Cerner: Second only to Epic in net new wins with 40 wins. Experiencing growth through CommunityWorks, a hosted solution. Customers share mixed opinions regarding Cerner’s technology but generally perceive Cerner to be strong at hosting. After losing 17 hospitals in 2010, they only lost 3 in 2011.

- McKesson Paragon: Had 31 wins with only 2 losses. Demonstrates some growth in the critical access space, but most organizations looking at Paragon are larger community hospitals for whom Paragon has been a good fit. With announcement of Paragon as go-forward solution, McKesson is working to retain or convert Horizon customers.

Revolving-Door Vendors–are so labeled for their steady flux of wins and losses.

- Healthland: Higher number of wins in 2011 (41) than in 2010 (40). Now sells only Centriq, a young, stillmaturing, web-based solution targeted at critical access and somewhat larger hospitals. Much of the data in this report is based on activity in the Classic customer base.

- CPSI: Offers an integrated legacy solution for critical access to 100-bed hospitals. Continues to see moderate growth (32 wins) but loss rate doubled in 2011 due to both legacy technology and servicerelated concerns.

- HMS: Only vendor to sell primarily to IDNs, where most 2011 wins came from. KLAS confirmed 19 wins.

- Siemens: Fewer clients converted to Soarian from MedSeries4 and Invision in 2011 than in 2010 (2 in 2011 and 13 in 2010). While deployment challenges have plagued Siemens in the past, more-recent go lives suggest improvement for Soarian.

- Allscripts: No significant energy in community space but some wins. Offers a larger, complex product. Has not proven to be a strong supporter of hospitals that need hand-holding in order to achieve MU.

At-Risk Vendors-are showing large decreases relative to growth in the customer base or have very little energy with their clinical product.

- MEDITECH: Successful at moving some customers to v.6.0 but others intimidated by the upgrade and are selecting alternative solutions. Some new customers are implementing C/S v.5.6 as first EMR.

- QuadraMed: Currently very minimal energy around QuadraMed’s clinical solution.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.