2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Segments

Go-Live Support 2013

Send in the Cavalry!

At go live, there is a lot at stake. As providers implement complex clinical applications, system adoption can pose a major challenge, especially with physicians. Many organizations are bringing in third-party resources to increase the success of their go lives, establish smooth workflows, and optimize their systems. This study explores the performance, offerings, and organizational impacts of go-live support vendors.

Worth Knowing

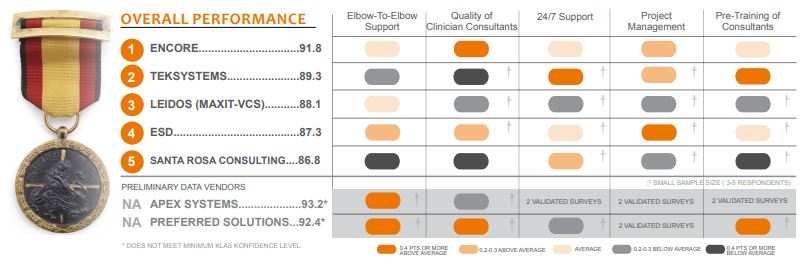

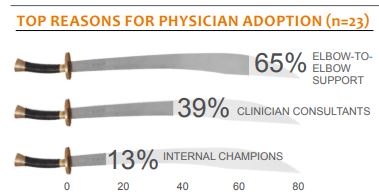

Elbow-to-elbow support makes the biggest impact on physician adoption:

ESD had the best impact on clients’ physician adoption, largely due to very effective elbow-to-elbow training. Encore clients were similarly impressed with the impact of Encore’s knowledgeable and capable on-site support. Santa Rosa and TEKsystems struggled.Quality of clinicians is key to credibility and results:

Strong clinician consultants lend immediate credibility with clients’ physicians, facilitating better physician adoption. Encore has figured out how to deliver very high-quality clinicians—as many as 30 to one client with physicians as many of the consultants. Preferred Solutions and ESD clients also highlighted strong clinician support as a defining benefit of their engagements.Encore is top ranked of all the firms in this study:

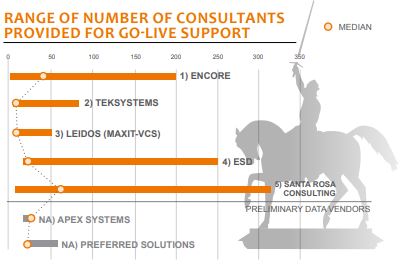

They delivered with strong physician consultants, an ability to scale up with a deep consultant pool, and experience running command centers. However, TEKsystems is tight on their heels with strong 24/7 support and effective pretraining of their consultants to provider policies and procedures. Early data vendors Apex and Preferred Solutions demonstrated early strong performance.Only three firms have proven ability of staffing very large projects:

Santa Rosa Consulting staffed the largest projects of any measured in this report (two that were over 300). Encore and ESD were next in line with 200+ consultant engagements. Though Leidos (maxITVCS) had the smallest engagements in this report, they have an industry reputation as being able to scale up.

BOTTOM LINE ON VENDORS

RANKED VENDORS

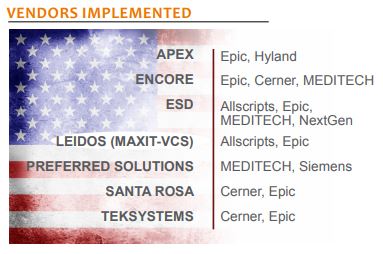

Encore: Top ranked in this report. Best known for delivering many physicians as consultants. Strong performance with project management and command center. Has strong ability to scale. Mixed feedback on elbowto-elbow support and pretraining caused scores to dip slightly. Documenting optimization opportunities was lowest-rated area.

ESD: Highest score in their elbow-to-elbow support and project management. Most variety of applications implemented of any vendor in this report; demonstrates strong Epic and MEDITECH application knowledge. Provided clinicians on almost every project—mostly nurses. Proven ability to scale above 200 consultants. Some complaints in 24/7 support responsiveness. Low experience running command centers and rarely provided optimization suggestions to clients.

Leidos (maxIT-VCS, an SAIC Company): Stuck in the middle. Provides good services but doesn’t stand out in any category. Solid performance with project management, 24/7 support, and impact on physician adoption. Most clients had positive prior relationship with maxIT. Clients had hit and miss experiences with consultant knowledge. Though the projects listed in this report were not very large, given the company’s size, one can assume that they should be able to scale to large projects.

Santa Rosa Consulting: Largest consultant deployments of any firm in this report, though had small engagements too. Their 24/7 support is a standout benefit but providers reported inconsistent consultant quality. Most providers chose them because of very solid recommendations. Lowest overall rank in this report.

TEKsystems: Comprehensive project management was deciding factor for multiple clients. Top score for 24/7 support, consultant logistics, and pretraining of consultants, and praised for consultants’ ability to learn quickly. Tied for lowest impact on physician adoption and lacked quality physician consultants.

PEER ADVICE

- Designate an internal evangelist for the adoption of the clinical system. Typically someone at the top, like a CMIO, can greatly influence physician adoption.

- Require pretraining of consultants on your organization’s policies, procedures, and culture.

- Diminishing the number of consultants on the project as the go live progresses can save money without impacting success.

PRELIMINARY DATA VENDORS

Apex: Fewer engagements than other firms in this report but received rave reviews on partnership and training. Elbow-to-elbow support is a definite strength. Some issues with poor project management or cultural fit of individual consultants. Engaged with Epic and Hyland clients, with a couple of very long projects.

Preferred Solutions: Consistently high ratings from all clients in this report, especially with the strong expertise of nurse and clinician consultants. Strong methodology and elbow-to-elbow support established credibility with physicians. Their 24/7 support was lowest area. Does large, shorter-length engagements. Smaller firm that focuses primarily on training.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.