2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Segments

.jpg?preset=report-cover-two-page-report)

.jpg?preset=report-cover-two-page-report)

2013 Ambulatory EMR Performance (1-10 Physicians)

The Quest for Value Amid Rising Expectations

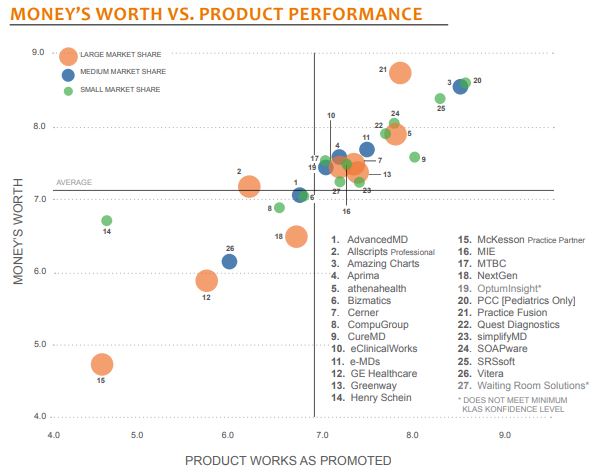

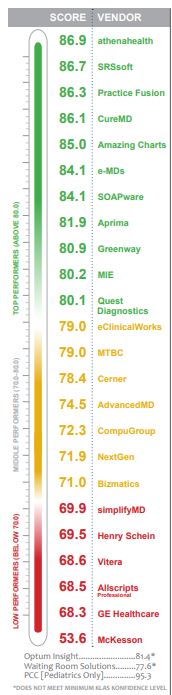

Providers in small practices (1–10 physicians) increasingly find themselves in a significant quandary—in need of all the EMR functionality demanded of a large organization but constrained by significantly smaller budgets. Additionally, providers voice the need for strong vendor support and communication to be successful. Are there any vendors that have a track record for delivering against such high expectations? A handful of vendors have implemented strategies that consistently deliver at a high level and foster quality relationships with their customers. For vendors that are struggling, replacement rates are increasing as providers search for the best-performing EMR in a hotly contested market.

Worth Knowing

Money’s Worth Matters Most– Vendors succeed when they deliver quick and easy implementations along with value-based products. Value is not defined by the pure cost of the EMR. Vendors that deliver well against these criteria are Amazing Charts, athenahealth, CureMD, Practice Fusion, and SRSsoft.

Poor Delivery among Well-Known Vendors– The lowest-performing vendors, in order, are McKesson, GE Healthcare, Allscripts, and Vitera (all with overall scores below 70). Customers from all four vendors point to unmet product expectations, poor upgrade releases, and inadequate relationships as key drivers in dissatisfaction.

Replacements Heat Up– Overall replacement rates are up for vendors who have failed to live up to providers’ rising delivery expectations. Clinical content alone is no longer enough. Providers leaving their current EMR cited poor service and vendor relationships as the primary reasons for replacement. Frustrations around product gaps, both codequality issues and poor usability, also drive replacement. Feeling nickeland-dimed is the third most cited concern from providers looking to leave. Vendors most at risk of being replaced are Allscripts, McKesson, and simplifyMD.

Bottom Line on Vendors

AdvancedMD: Customers reported unmet expectations around product development. Newly live customers cited better go-live experiences. Slight increase in overall scores year over year.

Allscripts Professional: Product hits the mark, but Allscripts stumbles in delivery. Described as “distracted.” Clients noted significant decrease in service coupled with an increased tendency to nickel-and-dime. Significant score drop over last year.

Amazing Charts: Customers continue to find value; 97% indicated that Amazing Charts does not nickel-and-dime. Strong system performance in light of costs incurred. Ease of use highlighted. Undelivered practice management causes frustration; some looking to replace.

Aprima: Customers noted significant improvements in code quality and enhancements in version 2011. Overall usability improvements, along with better service and support. One of the most optimistic customer bases in the study.

athenahealth: Significant national attention and mindshare. Delivers on customer expectations. Consistent, clean product enhancements and high service levels. For some, high costs cause frustration.

Bizmatics: Buyer’s remorse on the rise; very large number of clients indicated they would not buy again. Customers described frustration with the product’s immaturity and with poor vendor response to known issues. Scores remain flat year over year.

Cerner: Attention to development noted. Clients are largely optimistic that Cerner will deliver on promises. Improved customer relationships. Scores improving.

CompuGroup: Customers voiced concerns about needed functionality to meet regulatory requirements. Also noted additional money and effort required to get the application to perform at the level that was expected out of the box.

CureMD: Customers give high marks for responsive and quality support. Product described as cumbersome with complaints around system responsiveness.

eClinicalWorks: Physicians score higher than IT respondents, citing intuitive user interface and simple yet robust functionality. Affordability major factor in decisions. Customers noted recent service improvements; relationship frustrations linger for some. Significant market share and mindshare. Widely considered in decisions.

e-MDs: Strong service relationships and product ease of use. Steady track record of delivery. Slipping in provider mindshare. Code-quality concerns in latest versions have some customers disappointed.

GE Healthcare: Customers reported poor upgrade services and code-quality frustrations with v.10. Half reported that CPS does not have the functionality they need. Customers remain confident that GE can deliver; only a handful look to leave. Broad market share; dwindling mindshare.

Greenway: Dip in scores largely due to influx of new clients who reported frustration with implementation and training. Technology leader, highly usable product out of the box, templates well designed and intuitive.

Henry Schein: Adequate functionality; customers noted ease of use. Practices that have come live in the past two years complained of poor implementation services and a lack of adequate training.

McKesson: Significant score drop; lowest overall score in this study. Declining service levels and poor product releases are primary pain points. Most vulnerable customer base.

MIE: Not nationally recognized; regional install base. WebChart described as robust and highly configurable EMR.

MTBC: One hundred percent of clients reported that MTBC does not nickel-and-dime. High marks for service and support. Productrelated complaints revolve around usability, with customers citing too many required clicks and cumbersome user interface.

NextGen: Slight implementation improvements over past two years. Customers reported codequality issues with latest versions. Primary care scores lowest, due to inordinate amount of time for product setup. Customers look to KBM 8 as a needed facelift.

Practice Fusion: Customers find value, being free. Product functionality gaps noted, yet is maturing and in line with expectations. Optimism among customers. Steady score improvements.

Quest Diagnostics: Newly live customers give high marks to the product’s ease of configuration and online training. Single-doctor offices find Care360 meets needs, but practices with two or more physicians reported significant challenges with support and application downtime.

simplifyMD: Significant score decrease in overall performance. Complaints around poor system releases and upgrades, and decrease in support quality causes customer frustration.

SOAPware: Single-physician practices find value and report getting their money’s worth. High customer loyalty. Practices with two or more physicians look for more robust functionality and reporting.

SRSsoft: Largely considered in complex specialties. Support receives high marks. Customers still awaiting MU Stage 2 functionality.

Vitera: Guarded optimism around future offerings. Historically strong product, but executive turnover creates confidence gaps. Significant frustration with support.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.

.jpg?preset=report-cover-two-page-report)

.jpg?preset=report-cover-two-page-report)