2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Segments

Related Articles

Population Health Management 2013

Scouting the PHM Roster

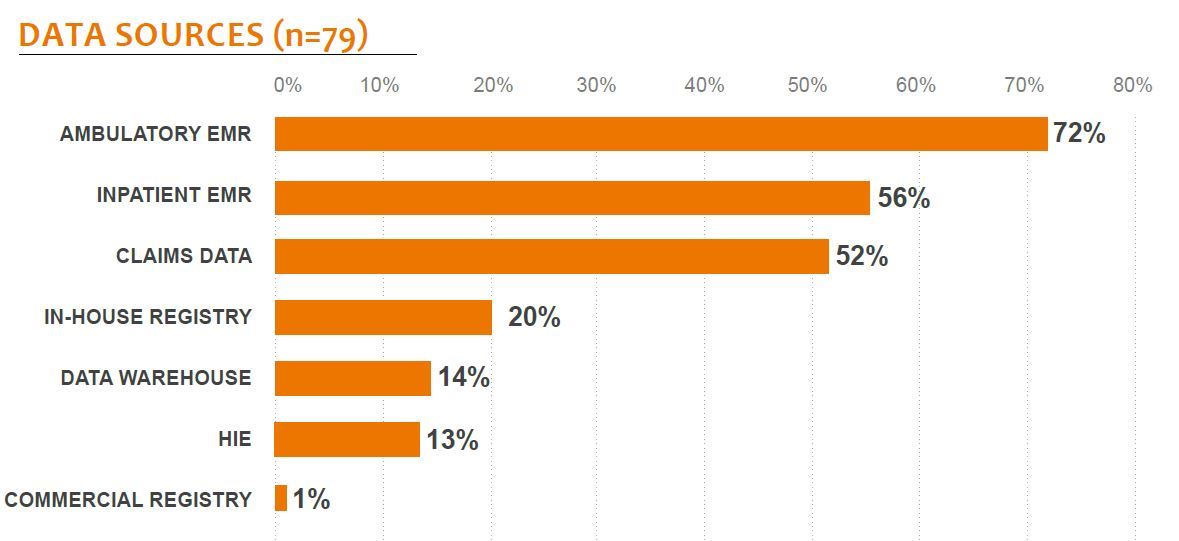

Vendors of all stripes are pouring onto the population health management (PHM) playing field. To get an early perspective on a still growing crowd, KLAS interviewed 78 providers about their use of 23 vendors. Vendors included have a combination of mindshare and customers, but few have enough live sites to produce a formal KLAS rating for their products. Nonetheless, KLAS’ goal is to provide insight into the following questions: What types of solutions are available? What are the strengths and weaknesses of vendor approaches? Which vendors have an opening lead in portfolio breadth, experience depth, and ability to deliver?

POPULATION HEALTH MANAGEMENT 2013

Scouting the PHM Roster

Report Author: Mark Wagner

Vendors of all stripes are pouring onto the population health management (PHM) playing field. To get an early perspective on a still growing crowd, KLAS interviewed 78 providers about their use of 23 vendors. Vendors included have a combination of mindshare and customers, but few have enough live sites to produce a formal KLAS rating for their products. Nonetheless, KLAS’ goal is to provide insight into the following questions: What types of solutions are available? What are the strengths and weaknesses of vendor approaches? Which vendors have an opening lead in portfolio breadth, experience depth, and ability to deliver.

NOTE: Vendors included were brought to KLAS’ attention in provider conversations but represent a subset of a growing number of options. Additional vendors have emerged and will continue to emerge, such as Alere, Evolent Health, Health Catalyst, Lumeris, Medecision, Treo Solutions, and SyphonyCare. KLAS will measure these and other vendors as data becomes available. See the Drill Deeper section for additional details.

WORTH KNOWING

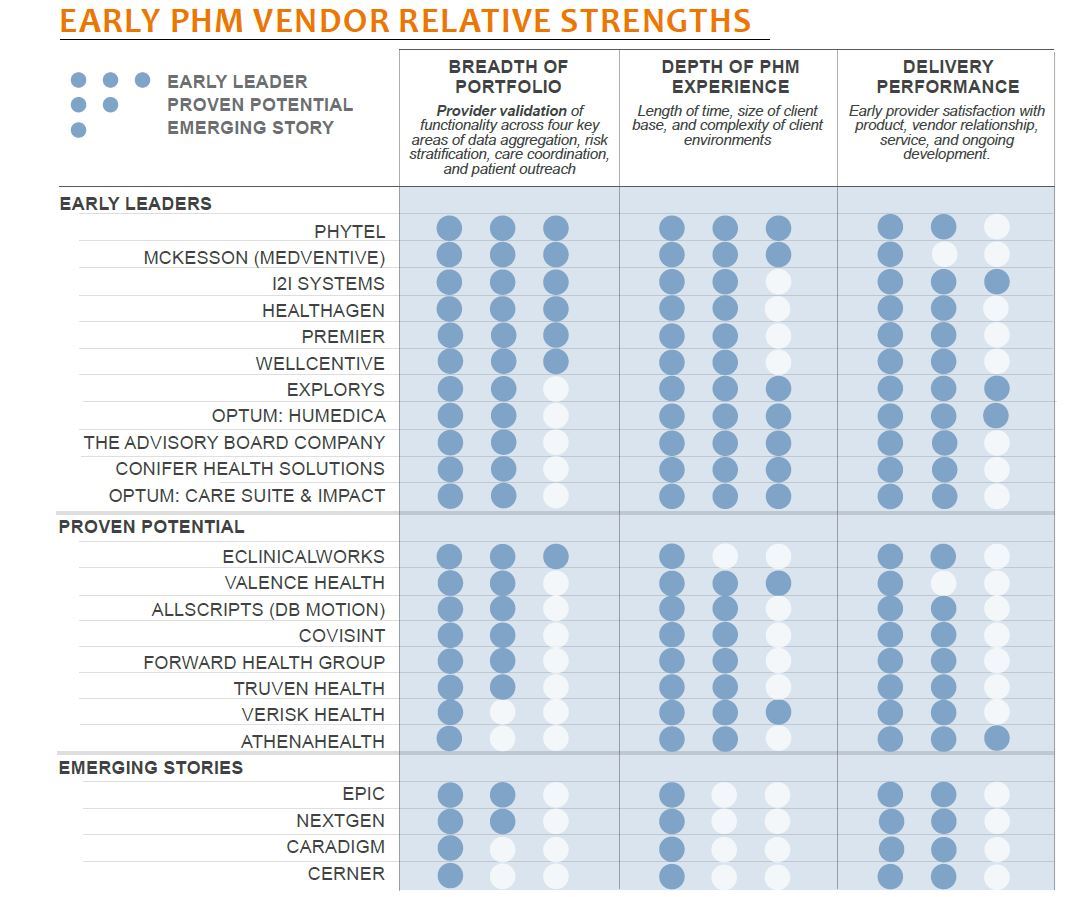

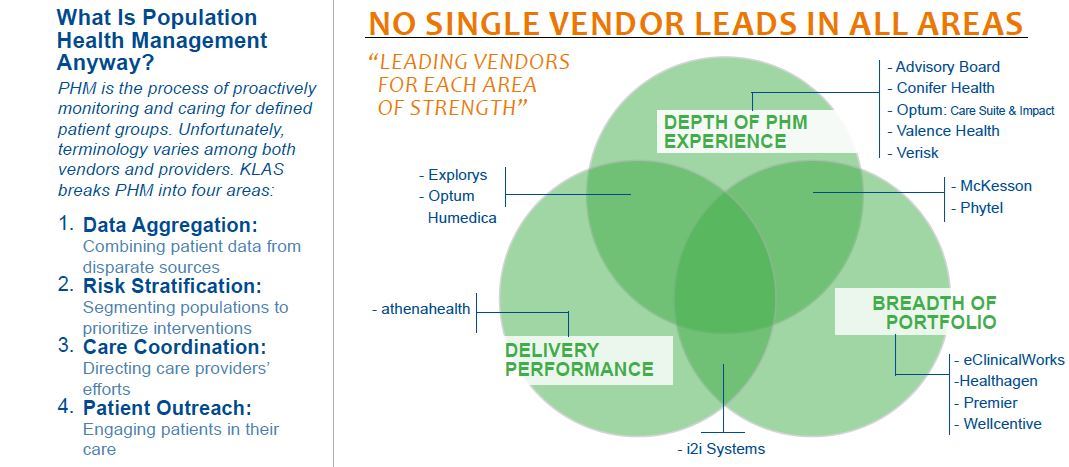

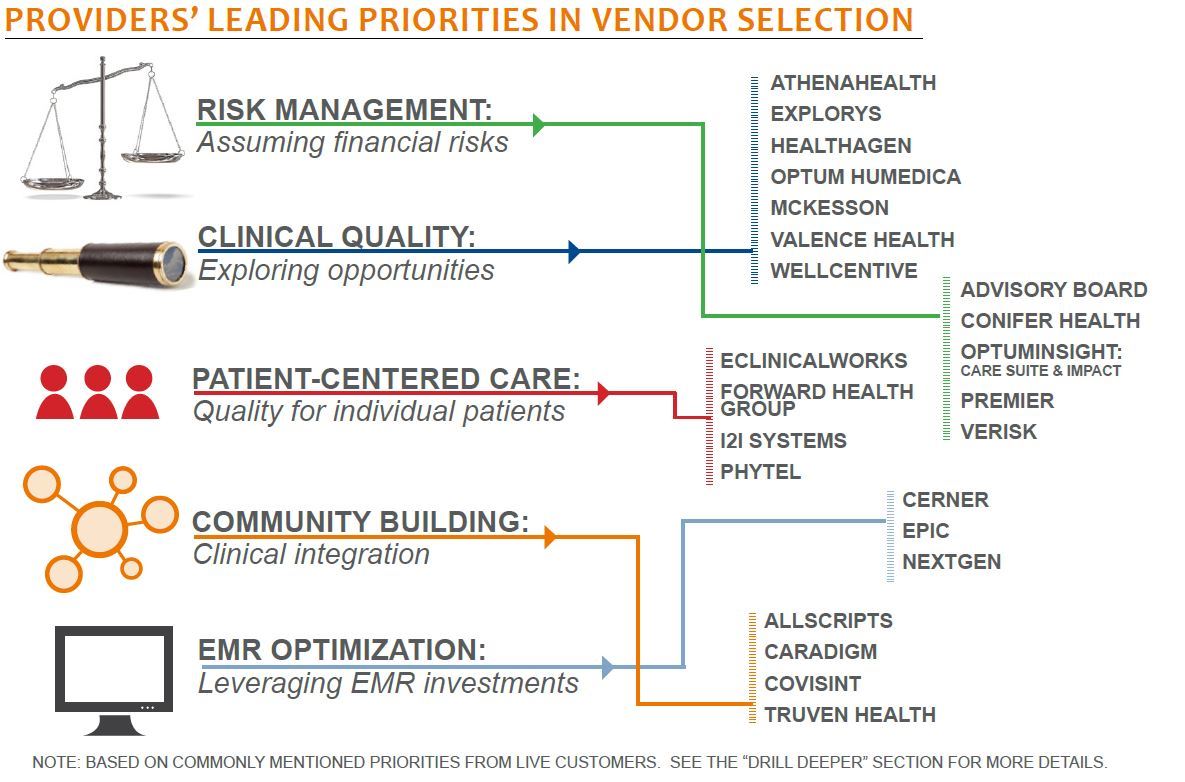

A CROWDED ROSTER THAT KEEPS GROWING Providers looking for a PHM solution face a long list of vendors hoping to be drafted onto providers’ teams. Unfortunately, vague language among vendors and unclear goals among providers cloud the picture, but some early leaders are emerging based on their portfolio breadth, experience, and ability to deliver: Advisory Board, Conifer Health, Explorys, Healthagen, Optum:Humedica, i2i Systems, McKesson, Optum: Care Suite & Impact, Phytel, Premier, and Wellcentive.

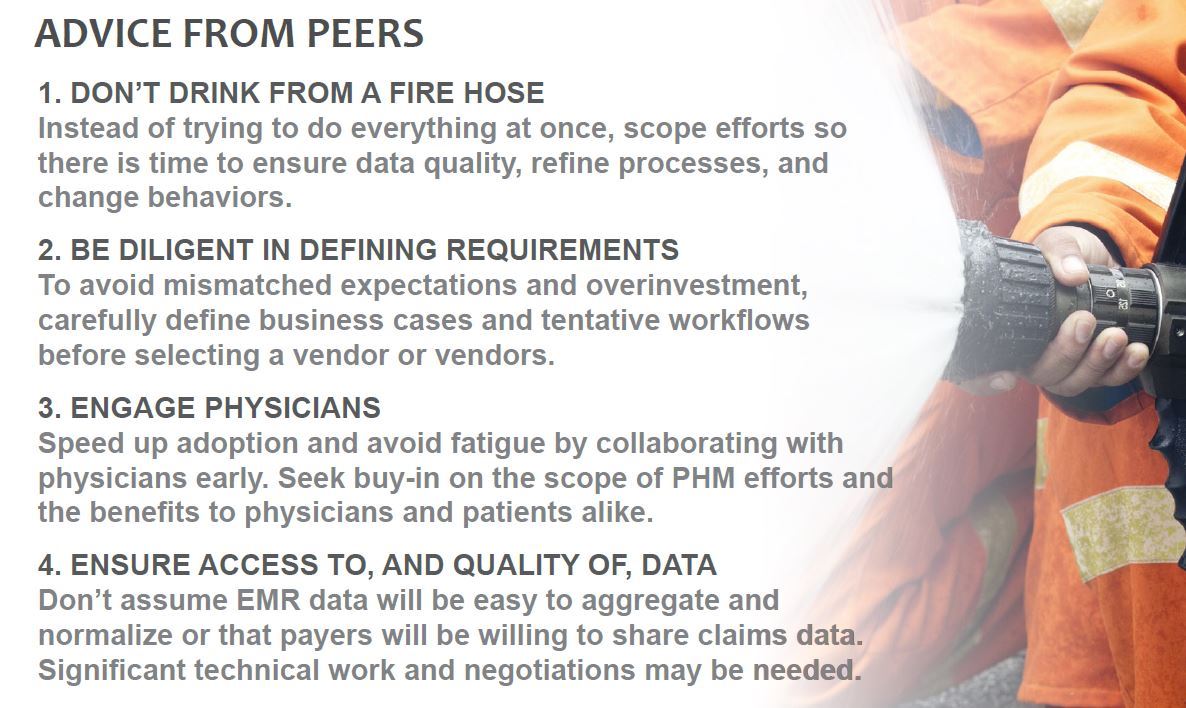

NO EASY BUTTON FOR PROVIDERS Explorys, Forward Health, and i2i Systems received the most consistent praise for guiding care coordination, yet automation is a misnomer for vendor solutions and PHM remains largely a manual process. The most labor-saving capability, patient reminders, is the least used as providers place the greatest value on prioritizing efforts of limited staff and facilitating communication among caregivers.

PHM IS FAR FROM A COMMODITY While vendors claim end-to-end solutions, each approaches the market with different strengths, such as risk management, quality analytics, and point-of-care guidance. Because of this, most providers use either a subset of functionality or stack multiple vendor solutions together. Vendors with the greatest validated portfolio breadth include Healthagen, i2i Systems, McKesson, Phytel, Premier, and Wellcentive.

EMR VENDORS GETTING INTO THE GAME Today, PHM is largely a realm of third-party vendors, but for many providers, a holy grail would be EMR integration, from back-end database to front-end physician workflow. Some EMR vendors, like Allscripts, McKesson, and athenahealth, are buying their way into the market through acquisition, but integration remains a challenge. Others, like Cerner, eClinicalWorks, Epic, and NextGen, are building capabilities in-house, but development is relatively slow. Among these four, eClinicalWorks’ solution is most comprehensive.

BOTTOM LINES ON EARLY VENDORS

EARLY LEADERS

THE ADVISORY BOARD COMPANY—Crimson suite offers range of functionality, but predictive risk analysis and provider performance reporting are most appreciated. Strong hospital focus and claims experience. Fast, predictable implementations, though less customizable system. Additional care management functionality in development. Patient outreach automation a gap.

CONIFER HEALTH SOLUTIONS—Healthcare business process outsourcing firm added PHM via InforMed acquisition in 2012. Clients taking on at-risk contracts report good success with claims data analysis. Patient risk profiles help in care coordination. Described as collaborative vendor, serving both payers and providers. A Tenet Healthcare subsidiary.

EXPLORYS—A leading healthcare-specific BI vendor that is making particular in-roads on population health. Cloud based with a friendly user interface that encourages physician use. Templates highlight gaps in care and physician performance. Often used in conjunction with other vendors. Lacks patient-outreach tools. Strong service and support.

HEALTHAGEN—Brings together recent Aetna acquisitions of HIE and mobile app vendors as well as PHM vendor ActiveHealth. Customers attracted by breadth of offerings, but few use all offerings. Relationship often part of larger Aetna partnership. History of supporting payers and employers.

OPTUM: HUMEDICA—Cloud-based solution maintains independence following Optum acquisition. Strong clinical analytics, benchmarking, and performance reporting. Value of predictive models leads customers to want more diseases covered, faster. Not seen as physician tool or for patient outreach. Supports NLP. Responsive service.

I2I SYSTEMS—Experienced ambulatory-focused vendor favored by primary care associations. Typically draws data from single EMR and often paired with NextGen. User-friendly reports focus physicians’ attention on individual patients at point of care. Relied on for quality measure reporting. Good referral tracking. A highly engaged vendor.

MCKESSON—Recent MedVentive acquisition brings strong name recognition and market share. Solutions described as mature and intuitive for physicians. Vetted by large health systems. Data aggregation/quality challenging for some. Risk-stratification module not highly adopted. Some implementation delays.

OPTUM: CARE SUITE & IMPACT—Most use Impact Pro’s claims-based analytics for owned health plans. More recent care coordination tool, Care Suite, still maturing but providers see potential. Care plans and decision support receive praise.

PHYTEL—Long experience in patient outreach a foot in the door for PHM. Suite adds tools for analytics and care coordination. Broad functionality draws IDNs, but special appeal for ambulatory settings and PCMH efforts. Works well with clinical data, paired with Verisk Health for claims analysis. Rebranded by Premier.

PREMIER—Population Advisor suite includes technology from NetworkFocus,Phytel, and Verisk Health. Offers respected ACO collaborative, consulting, BI, and data warehouse.

WELLCENTIVE—Visually attractive and user friendly for physicians. Good aggregation. Described as affordable. Strong customer service/relationships. Attractive to physician-led groups with hospital associations. Offers customizable risk models, but some want more financial performance capability.

NOTE: VIEW BOTTOM LINES ON OTHER VENDORS IN DRILL DEEPER SECTION

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.