2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Outpatient Pharmacy 2013

What Does My Vendor Deliver?

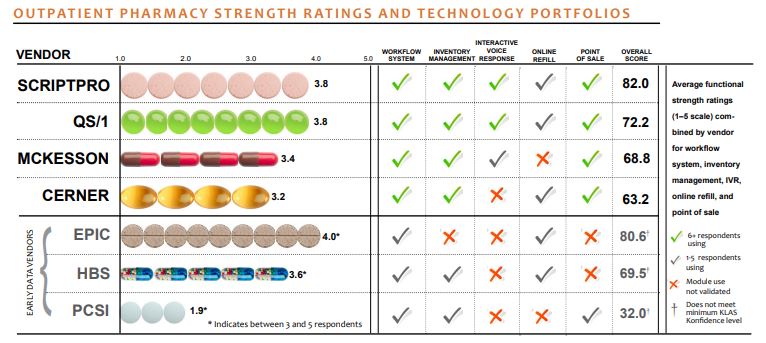

With a large number of providers looking to expand their 340B business, outpatient pharmacies have the potential to be an added revenue stream for healthcare systems. This study explores the performance of the various modules that outpatient pharmacy vendors offer. This study also investigates vendors’ efforts around accountable care and 340B. Does any vendor stand out as a leader?

Worth Knowing

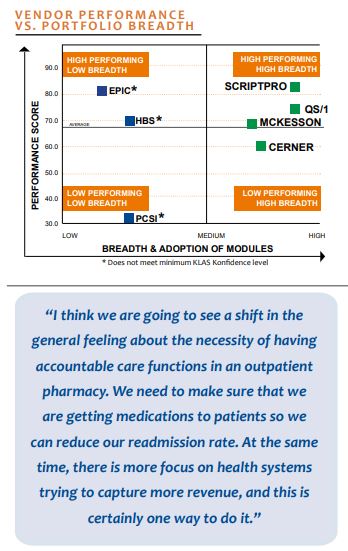

ScriptPro’s Service Sets Them Apart: ScriptPro’s modular strength ratings are tied with QS/1’s for the highest overall and are above average for most measured areas, though online refill and IVR have room to improve. ScriptPro’s overall performance is almost 10 points ahead of second-place vendor QS/1, thanks to highly touted service and implementation teams. ScriptPro’s robot is a key strength, helping increase their software customer base.

Back to the Basics: Performance scores for outpatient pharmacy systems are well below scores for other healthcare segments rated by KLAS. The top-two provider demands for improvement focus on the basics: better workflow functionality and improved software quality. While the modules offered by ScriptPro and QS/1 are more highly regarded by providers, all vendors have room for improvement, especially with inventory management and online refill. With the exception of ScriptPro and Epic, providers also want to see their vendors improve their overall service.

Providers Putting More Focus on 340B: One-third of providers said they intend to expand 340B services in order to capture more revenue. While all vendors showed room to improve, the flexibility of QS/1 NRx makes it the best suited to help providers meet the requirements for 340B. McKesson, Epic, and PCSI were the least suited to support providers’ 340B goals.

Outpatient Pharmacy Is Not a Big Part of Accountable Care, Yet: As it stands today, the outpatient pharmacy is not playing a key role in accountable care efforts within healthcare systems, partly because integration with inpatient systems is lacking. It seems that bedside checkout could positively impact medication management and lower reasons for readmission. However, providers have not formulated clear plans pertaining to outpatient pharmacy’s role in accountable care. When asked what vendors are doing to help, 86% of providers indicated that they were uninformed of their vendor’s efforts around accountable care or said that their vendor was doing nothing.

Can Bedside Checkout Make an Impact?

Bedside checkout is one way that providers can increase outpatient pharmacy capture rates (i.e., getting patients their medication before they leave the hospital), which some providers have said can help reduce readmission rates. McKesson and QS/1 are starting to offer bedside checkout technology. KLAS validated one QS/1 customer currently using bedside checkout, with others planning to adopt. McKesson customers anticipate this functionality as well.

Bottom Line on Vendors:

1st ScriptPro (82.0): Highest-performing vendor in the study with a broad portfolio of technology, including their highly rated dispensing robot. Performs above average for inventory management, POS, and workflow but below average for IVR and online refill. Tight integration across modules but little interoperability with inpatient systems. Customers in both retail and outpatient pharmacies. Good implementations and dedicated training set providers up for success.

2nd QS/1 (72.2): A distant 10 points behind top-performer ScriptPro. Broad offering of pharmacy modules, which are tied for best in this report. POS module interface well liked and well adopted. Inventory management and workflow system both meet providers’ needs but not wowing. IVR works well but missing callback feature. Best positioned to help with 340B. Mix of retail and outpatient pharmacy customers.

3rd McKesson (68.8): Respondents in this study were almost exclusively in outpatient pharmacy settings. Offers most pieces, but missing online refill and few using IVR. Forty-three percent said missing needed functionality. Workflow module highly regarded in an underperforming portfolio. Many using Parata for robot. Providers plan to stay with McKesson. Many mentioned having to pay for every little thing.

4th Cerner (63.2): Most customers are in outpatient pharmacy setting. Lowestperforming fully rated vendor in the report. Performance is average or below average for most modules. Few using online refill. IVR not offered. Little interoperability with Cerner’s inpatient EMR. Support spread thin and less responsive in the East due to West Coast–based support structure, although customers noting recent improvements.

Early Data Vendors:

Epic (80.6): Providers pleased with service, communication, and integration, but Willow Ambulatory is still immature in breadth of offering, and only 38% say it offers all needed functionality. Online refills offered through Epic MyChart. Providers pleased with what is offered (online refill and workflow) and optimistic that Epic will improve and offer more over time.

HBS (69.5): Fast system that is easy to use. Offers workflow and inventory management. A few using online refill. Communication and service have room to improve. Poor interoperability with third-party vendors.

PCSI (32.0): Offers inventory management and workflow system functionality, but performs well below average. A few using it for POS. Poor software quality, slow development, and poor support. Highly vulnerable to replacement. Providers claim some interoperability with their inpatient systems. New v.7.25 did not improve performance.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.