2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Is Cloud Disrupting Stagnant ERP Market?

ERP Performance 2015

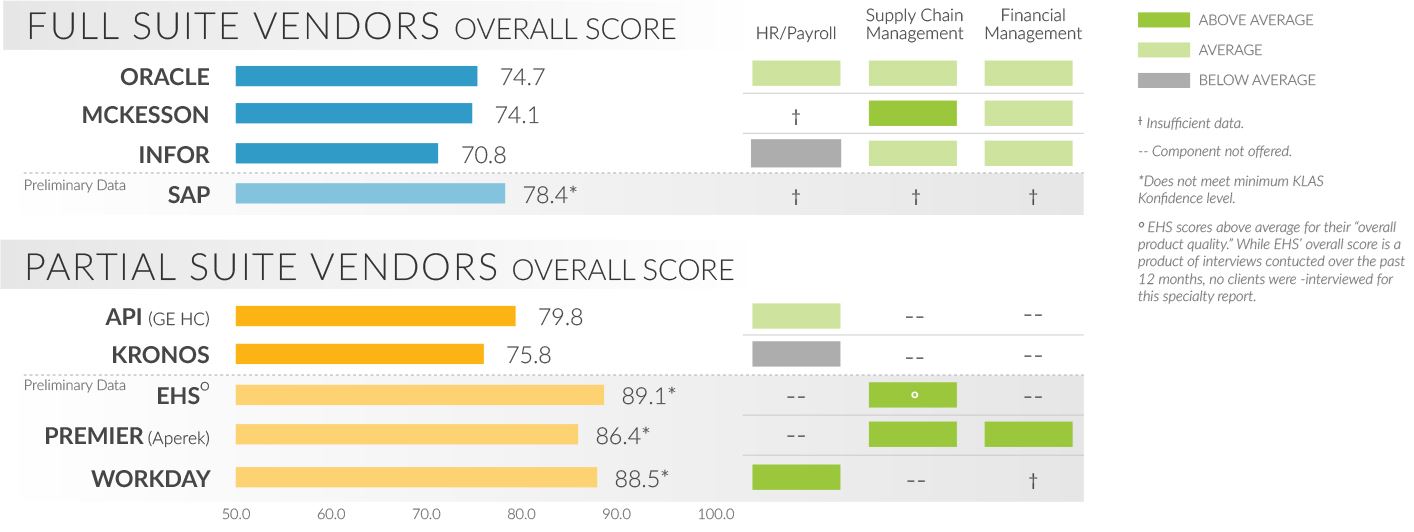

For years, the healthcare ERP market has been dominated by Infor, McKesson, and Oracle whose satisfaction scores have been static and whose delivery of service and functionality has been inconsistent. However, healthcare provider interest in the cloud is creating increased mindshare for newcomer Workday, whose next-generation technology and collaborative service could be the innovation the market has been looking for.

1. INFOR AND ORACLE MAINTAIN STORAGE FOOTHOLD DESPITE INCONSISTENT PERFORMANCE

Full-suite heavyweights Infor and Oracle have by far the largest market share in healthcare ERP, but clients consistently report mediocre performance. Some Infor clients experience strong partnership and communication, and many are excited about Infor’s go-forward Xi cloud platform. Others are very hesitant to commit further due to poor service and the cost of new functionality. Some Oracle customers appreciate that Oracle releases regular mini-upgrades that can be implemented quickly; others feel they are constantly being sold to and that upgrades are too costly. Oracle is still working to gain traction with their Fusion cloud offering. SAP has the largest global ERP installation base outside of healthcare, which stands in stark contrast to their small U.S. client pool within healthcare. Only time will tell whether SAP’s new cloud offering, the S/4HANA suite, will change the story.

2. MCKESSON MOST AT RISK FOR LOSING CUSTOMERS, YET SUPPLY CHAIN SEEN AS MAKING STRIDES

Though McKesson has gained some new customers through health-system consolidations, they have had very few other wins, and they struggle to compete with the other major ERP players for customer mindshare. McKesson’s weaker financial system and the low adoption levels of their bare-bones HR product result in McKesson not often being considered by providers looking for one-stop ERP. Existing customers generally characterize the vendor’s development as stagnant, yet they do feel some excitement around McKesson’s supply chain solution, which includes cloud-based procurement. McKesson’s HR/payroll system remains anemic.

3. EARLY DATA SHOWS WORKDAY PERCIEVED AS MOST INNOVATIVE WITH MOST POTENTIAL TO DISRUPT MARKET

The majority of providers KLAS interviewed for this report don’t feel any ERP vendors are innovative or are unsure of which ones are, but of those providers who specified a vendor, the majority named Workday. Though Workday is still establishing a presence in healthcare (KLAS interviewed 8 out of Workday’s fewer than 15 live clients), they have hit a sweet spot in ERP—an integrated, functionally rich, cloud-based HR system coupled with strong client collaboration. While a supply chain solution is still in development, providers regard Workday’s mobile and analytics capabilities as innovative, and high optimism exists around Workday’s potential to deliver a full suite of next-generation ERP technology. When it comes to the other partial-suite vendors, Premier (Aperek) is reported to deliver a user-friendly system with robust inventory/scanning functionality and a healthcare-specific ASP model that drives down costs. With fewer than 70 live clients, Premier has a much smaller client base than any of the big three players. The vendor proactively solicits enhancement requests and are highly praised for their mobile inventory technology. Their financial management solution is functional but lacks a budgeting piece. Established human capital management vendors API Healthcare (a GE company) and Kronos are used only for HR/payroll. API (GE HC) offers an easy-to-use HR system. Multiple customers say that while API (GE HC) is responsive to smaller issues, they are unresponsive to enhancement and major programming requests. Kronos customers complain of old technology but say the vendor’s newer version provides improved integration and reporting. Electronic Healthcare Systems (EHS) delivers a full, healthcare-specific supply chain management system to a small but very satisfied client base. The system is user friendly, flexible, and reliable, but providers report buggy upgrades.

4. PRELIMINARY VENDORS EHS, PREMIER, AND WORKDAY EXCEL AT INNOVATION AND COLLABORATION

Cloud technology is considered by many providers to be the future of ERP innovation, as it has the potential to provide flexible integration, reduced ongoing costs, and next-generation analytics/mobile functionality. While many vendors offer cloud platforms, providers view Premier and Workday as a class above for combining strong cloud technology with collaborative development; providers feel these vendors quickly implement user suggestions in beneficial, easily installed upgrades. EHS does not offer a cloud-based solution, but clients report that the EHS product is flexible and has a simple GUI and that the vendor is willing to go the extra mile in serving customers. Oracle, Infor, and others have strong value propositions for their cloud-based solutions, but many of their customers report that they are waiting to see what other vendors develop. One Infor client stated, “We are not going to jump ship right away, but we are going to keep our ears open to see how things develop and how this new breed of ERP solutions enters the competition.”

Writer

Elizabeth Pew

Designer

Natalie Jamison

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.