2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Segments

Population Health Performance

Emerging Market, Emerging Value

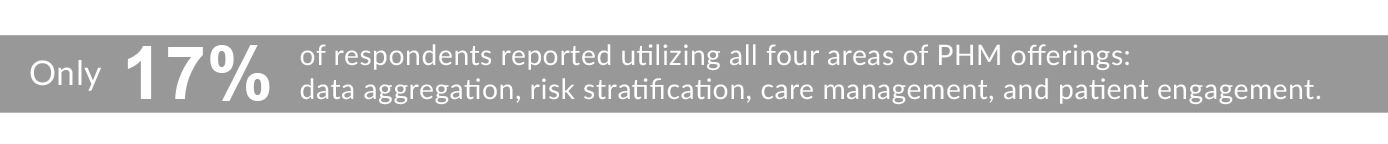

Today, energy around population health management (PHM) solutions continues to grow, with some vendors starting to deliver value. While most vendors currently have a small number of live clients, PHM offerings abound and the number of solutions is still increasing. Which vendors are effectively driving outcomes? Where is the needle when it comes to providing better patient care and reducing costs? KLAS interviewed 203 providers at 173 organizations to find out.

WORTH KNOWING

PHYTEL EMERGING AS THE EARLY LEADER AS PERFORMANCE GAPS WIDEN IN THE PHM ROSTER.

Phytel currently stands 10 points above the PHM market average as a result of quick implementations, deep user deployment, and high provider satisfaction in all performance areas. All Phytel respondents reported tangible benefits and a high number of linked clinics.

70% REPORTED TANGIBLE OUTCOMES, WHILE EXPLOR YS, PHYTEL, AND WELLCENTIVE RESPONDENTS ACHIEVE EVEN MORE.

Phytel is the most mentioned for helping customers effectively manage their general and high-risk patients through better prevention and care planning.Explorys and Wellcentive are most mentioned for improving outcomes and quality measures, and Wellcentive respondents also mentioned achieving better care planning.

HIGH CONSIDERATION YET RELATIVELY LOW ADOPTION TODAY OF EMR PHM OFFERINGS. ONL Y EPIC AND ECLINICALWORKSHAVE ENOUGH EARLY CUSTOMER PARTICIPANTS TO GENERATE A PERFORMANCE SCORE.

In a KLAS perception study earlier this year, PHM solutions offered by EMR vendors had the highest consideration among providers planning a population health strategy. EMR vendors are just starting to compete, and not many providers are utilizing their solutions at this point. athenahealth, NextGen Healthcare, Cerner, and Siemens still have a very limited number of live sites compared to their EMR client bases.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.