EMR Market Share by the Numbers: The Cerner/Siemens Acquisition, Part 2

In the first part of this blog post, we covered acute care EMR market share trends over the last four years and some of the pressures that led to Cerner’s acquisition of Siemens. This entry examines competitiveness and how Siemens does (or doesn’t) change the market-share picture for Cerner.

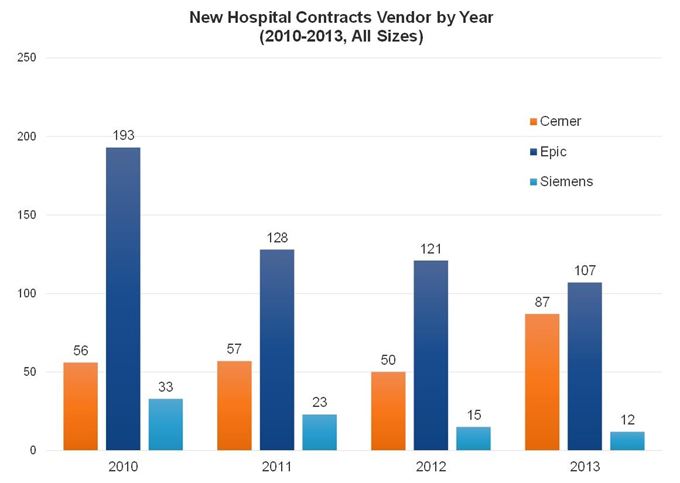

For several years, Cerner has taken second place to Epic in the annual race to sign up new hospitals. Lately, that gap has been shrinking when it comes to raw hospital counts. In 2013, Epic added 20 more hospitals than Cerner—quite a difference from 2010, when the margin was 137 hospitals. Does this mean that Cerner is becoming more competitive? Consider the following:

Does this mean that Cerner is becoming more competitive? Consider the following:

- In 2013, Cerner signed a very significant new customer right in KLAS’ backyard: Intermountain Healthcare. That deal, plus one other stemming from an IDN merger, accounted for 40% of Cerner’s 87 new hospitals.

- Aside from Intermountain, Cerner won only two new IDN customers in 2013, each with one or two hospitals. Most other wins came from customer add-ons or were smaller standalone hospitals (the latter averaging 79 beds).

- Epic’s 2013 wins included 15 new IDNs that switched wholesale from other vendors. On average, each had 5 acute care hospitals with an average of 300 beds.

If the EMR market were high school, you might say Epic was winning the popularity contest and was just voted king of the prom—again.

Enter Siemens

With Siemens, Cerner will have the largest U.S. market share of any vendor: 1,132 acute care hospitals. They will also take that distinction away from Epic, who took it away from MEDITECH only last year.

The tag “largest market share” makes for a nice press release, but the big question is where things will go from here. After all, doesn’t the popular saying go, “When you are at the top, there is only one way left to go”?

On the one hand, “down” is almost inevitable. Siemens has been losing market share, and the Cerner acquisition is unlikely to slam the brakes on any customer departures.

On the other hand, Cerner could win over the Siemens customers that have been gazing at the exit door. Last year, 15 hospitals left Siemens. Only 2 of them switched to Cerner, and that was due to acquisitions by Cerner health systems. Most other switchers went to Epic.

If Cerner can build meaningful relationships with existing Siemens customers and demonstrate a realistic path for transition, they may see some success. And Cerner has a few things going for them:

- Larger Siemens customers might find some appeal in the flexibility of Cerner’s offerings. Both vendors have a reputation for more open, mainstream technology.

- Recent Siemens buyers tend to be smaller and more cost conscious. Two-thirds of current Siemens hospitals are under 200 beds. Cerner has successfully appealed to these types of organizations in the last few years.

- Cerner’s customer satisfaction has risen steadily over the past few years. Most scores are far from industry leading, but they tend to be above average and often rate higher than the solutions Siemens customers are using today.

In the End

As my colleague Jon Christensen noted, Cerner faces an uphill battle. Historically, many big HIT mergers have been branded failures, and even some of the most successful were optimistically described as distractions. KLAS is currently speaking with Cerner and Siemens customers to find out their opinions, expectations, and plans.

I, of course, don’t know what will happen, but I find this merger to be novel in that it is not being made in desperation. Cerner is a relevant player with or without Siemens. Personally, with this merger, I see less of what we at KLAS call “magical thinking”: Cerner doesn’t seem to be claiming that a single stroke from a Wall Street pen will save both companies (and all of healthcare as a side effect). A thoughtful, realistic, provider-centric approach will benefit Cerner and Siemens, and the rest of the industry by example.

Cerner/Siemens Acquisition 2014: A Side-by-Side Comparison

Clinical Market Share 2014: Competition Mounts as Markets Collide