2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Radiation Therapy 2013

Striving for Accuracy and Upgradeability

Radiation therapy vendors are working to innovate at a quick pace by offering new technology regularly. With so many upgrades and new technology, are vendors able to still deliver the basics, like great support, uptime, and reasonable pricing? Which vendors truly have customer adoption of SRS and SBRT? KLAS spoke with 169 providers to find out.

Worth Knowing

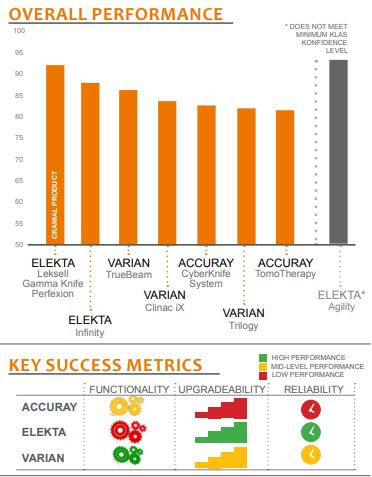

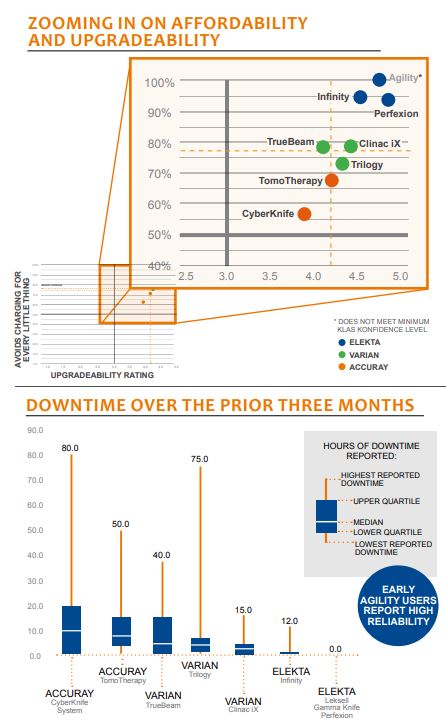

Elekta Sets a High Bar for Reliability—Elekta Leksell Gamma Knife Perfexion customers reported zero downtime and Infinity had very little. In contrast, Varian and Accuray customers deal with higher downtime on their advanced systems. Accuray CyberKnife customers accept downtime as a matter of course. Some reported that the expected downtime is exacerbated by a small field support staff. Accuray TomoTherapy customers also reported regular downtime and gave TomoTherapy the lowest reliability scores in the study. Several TrueBeam users also accept higher downtime, citing relatively new technology and bugs that are still being worked out. Varian TrueBeam customers noted that downtime is more frequent than expected but stated field support is responsive. Trilogy customers also reported downtime issues, while users of the older Clinac iX said it is relatively stable.

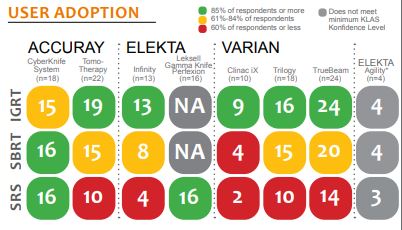

CyberKnife and TrueBeam Lead SBRT Adoption—CyberKnife customers are performing a wide variety of procedures and had the most customers using SBRT. TrueBeam is also showing wide adoption of SBRT. However, Clinac iX customers reported lower numbers of SBRT procedures based on a small number of interviews. The Elekta Infinity is not being used for SBRT as much; however, of the four Agility customers in the study, 100% are using SBRT.

Perfexion & CyberKnife Have Highest SRS Adoption and Satisfaction—The Gamma Knife Perfexion earns extremely high performance scores across the board and is known as the premiere treatment for brain cases. Many CyberKnife customers are also treating the brain. Those customers are very pleased and feel CyberKnife is incredibly accurate. The one drawback for CyberKnife is that treatment planning and patient treatment times are long, unlike with the Perfexion, which has quick treatment times.

Cost and Upgradeability Are Top of Mind—Elekta is the most customer friendly with upgradeability, and most customers see value with the opportunity to upgrade from the Infinity to the Agility, the new 160-leaf MLC. The Perfexion earns the highest upgradeability rating—the original Gamma Knife move to the Perfexion was well executed and delivered great new technology. On the other hand, Accuray CyberKnife customers appreciate the new technology that is constantly available to them but are clearly frustrated with the cost of upgrades. Accuray TomoTherapy customers are frustrated with the costs of service contracts since Accuray took over. Varian lands in the middle with their product line; the TrueBeam is expensive, but the vast majority of providers say it is meeting their needs.

Bottom Line On Vendors

ELEKTA: Providers enjoy working with Elekta. Proactive support structure aids consistently excellent uptime with Infinity and Perfexion. Relatively small install base in North America.

- Perfexion: Offers speedy, incredibly precise treatment. Highest rated for beam accuracy. Best field support and leader in upgradeability. Limited use to treating brain is benefit and challenge. Treats much smaller patient volume than linear accelerator. Needs large population base to draw from to support it, but users consider it the best treatment for specific brain cancers.

- Infinity: Easy to use and functional due to automation, but slow to grow market share. Good upgradeability. Proactive support leads to excellent interaction with Elekta. Lowest rated for beam accuracy and IGRT.

- Agility: Elekta’s new offering to compete head-to-head with TrueBeam. Starting out strong, though only a small sample reporting. Early adopters doing wide variety of treatments, both SRS and SBRT. So far customers are pleased. Many Infinity customers desire the MLC upgrade to Agility.

- Synergy: Elekta’s base model linear accelerator. Lower price point and upgradeability to Infinity.

VARIAN: Market share leader. Improving responsiveness. Frustrations working with Varian less pronounced than in previous years. Clinac iX and Trilogy customers report continuing contracting problems due to inflexibility.

- TrueBeam: Account management for TrueBeam much better than for Clinac iX or Trilogy. Technology leader with top-rated IGRT, beam accuracy well received, and high adoption of SRS and SBRT. Some experience downtime and lack of proactive service.

- Clinac iX: Better uptime on average than TrueBeam or Trilogy, but less SRS and SBRT users than TrueBeam or Trilogy. Solid linear accelerator used for basic treatments.

- Trilogy: Offers providers a wide range of treatments for patients using RapidArc. Only 81% would buy again—below market average. Implementation and training struggles.

ACCURAY: Severe downtime issues for TomoTherapy and CyberKnife. Service contract pricing causing pain. Both systems described as incredibly accurate and precise.

- CyberKnife: Product meets or exceeds providers’ expectations. Contracting, account management, and upgradeability are areas to improve. Lauded for developing new technology, but expensive. Despite issues, 95% would buy again.

- TomoTherapy: Most continue to be pleased with field support though a few say it has gone downhill since Accuray took over. Reliability issues still plague many customers. Lack of integration, or cost to build an interface, is painful. Only 86% would buy again, which is below average.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.