2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Quality Management 2014

The Race Gets Closer

As the focus in healthcare shifts from quantity care to quality care, healthcare providers need great vendor tools to manage quality and drive performance improvement. Despite different vendor approaches and products, the race to deliver a great client experience and help providers be successful is more important than ever before.

BOTTOM LINE ON VENDORS:

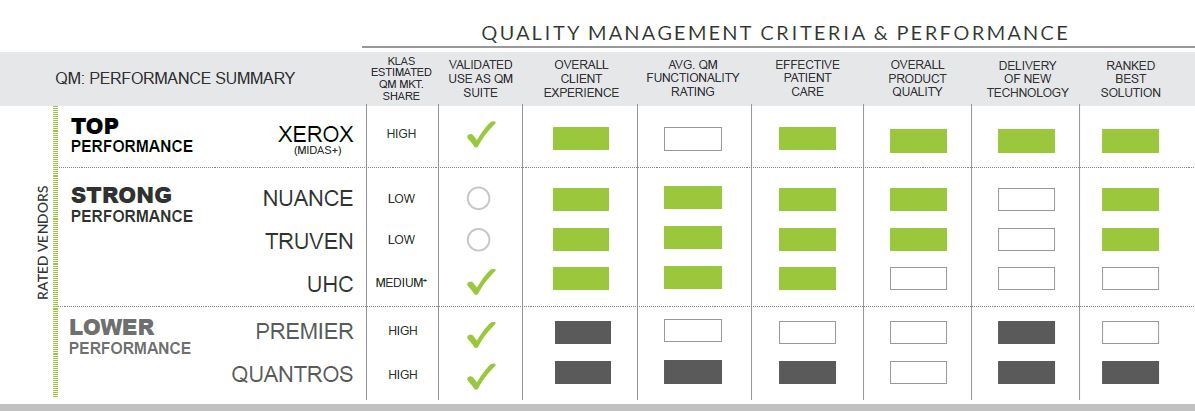

RATED VENDORS

NUANCE:

Noted for strong performance and receives very high reviews in regulatory reporting. Continued product development and strong support have helped retain customer confidence following QuadraMed acquisition. Not rated in safety/risk management or seen as a driving force in provider benchmarking strategy.

PREMIER:

Has one of the largest client bases. Receives many mixed reviews (i.e., highs and lows), resulting in inconsistency and a lower performance among rated vendors. While some clients praise Premier’s collaborative and broad products/services, most struggle with software usability issues and complex reporting.

QUANTROS:

Receives some of lowest scores from clients, in part due to older technology. Unique with highest adoption of risk management functionality. While clients see Quantros as one of the most cost-effective options, they rate the vendor low overall for patient-care effectiveness due to usability issues and insufficient insights from data (i.e., sub-par benchmarking).

TRUVEN HEALTH ANALYTICS:

High client ratings and seen as very effective in helping improve patient care. Providers appreciate vendor’s efficiency and actionable data. Truven’s “100 Top Hospitals” rankings have boosted QM image. Some providers see the system as cumbersome, noting lack of speed and flexibility. Rarely used for risk management.

UHC:

One of select vendors with strong overall performance; receives highest client satisfaction in external benchmarking and risk management. Partnership with Datix for risk management well received by providers. Compared to other strong performing vendors, receives lower ratings in regulatory reporting due to usability and time-lag issues. Mostly limited to—but seen as great choice for—academic medical centers.

XEROX (MIDAS+):

Highest client adoption validated across all QM areas, with high performance among breadth/depth of offerings. Perhaps closest vendor to achieving true “suite” adoption of QM. Has received most consistent positive reviews from clients for last three or more years, but competition now steadily increasing amid a changing market. Some clients want better GUI interface and deeper analytics.

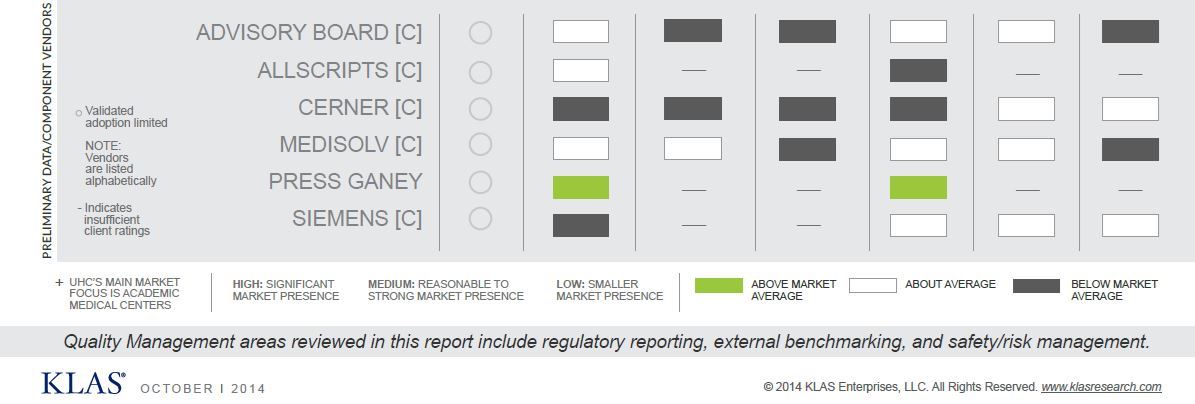

PRELIMINARY DATA/COMPONENT VENDORS

ADVISORY BOARD:

Seen as leading choice in physician performance with high adoption of external benchmarking; overall about average performance in the QM market. Receives overall low client ratings for impact on patient care. Clients see the system as valuable but often also expensive. Competitive options increasing.

ALLSCRIPTS:

Allscripts clients only; typically those with the vendor’s inpatient EMR. Clients mostly use the product for regulatory reporting; some also use it for clinical BI. Client-reported struggles include nickel-and-diming and challenges getting started with the product. A few clients happy with recent improvements.

CERNER:

Cerner clients only; adoption of regulatory reporting product and related performance-improvement consulting/services mostly fueled by broader Cerner relationship. Average performance for regulatory reporting. Low client-reported impact on patient care, mostly due to difficulties in usability.

MEDISOLV:

100% of clients use for regulatory reporting. While many customers give positive reviews, performance has slipped since last year. Strengths include ease of use and integration with MEDTECH’s EMR. Some clients see reports as cumbersome. Due to its use mostly as a regulatory reporting tool, the product is seen as less effective in impacting patient care.

PRESS GANEY:

Vendor is known primarily for patient satisfaction but also has products for regulatory reporting and benchmarking. Receives great reviews from small sample size of providers interviewed in this report; clients give Press Ganey uniquely high marks for vendor service and involvement. Not well recognized for quality management outside their own customer base.

SIEMENS:

Strengths are capable meaningful use reporting and the ability to automate otherwise manual tasks and abstraction. Despite the system’s potential and some great client experiences, the vendor receives overall lower performance ratings due to product complexity, steep learning curve, and rocky implementations.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.