2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

IT Outsourcing 2013

Who Can Help with Rising IT Pressures?

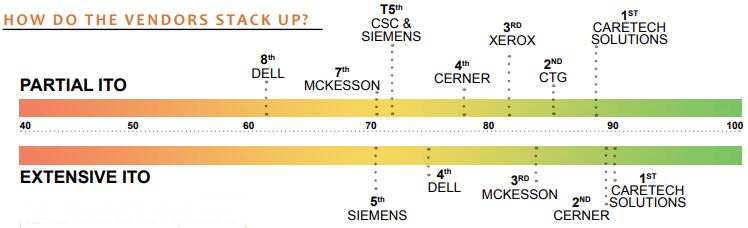

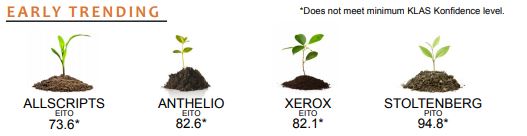

Amidst meaningful use (MU) and regulatory pressures, hospitals need help. More hospitals are partially outsourcing their IT than outsourcing everything. Increased PITO is driven by providers’ desire to maintain control over their IT environment, difficulty finding specific expertise, or need for temporary manpower during a system transition. CareTech Solutions, CTG, and Xerox lead the PITO market while CSC, Dell, McKesson, and Siemens struggle. While overall EITO growth is relatively flat, Cerner has experienced noticeable growth in this area and CareTech and Cerner have separated themselves from the rest of the pack as the top performers in this space.

Key Findings

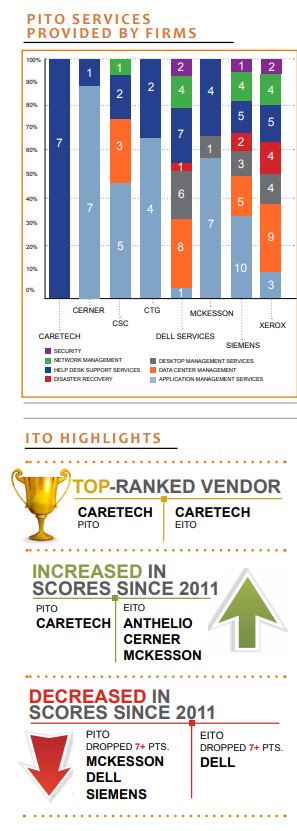

CareTech Solutions Continues to Shine in ITO—After receiving the Best in KLAS award in EITO four years in a row (2008–2011), CareTech experienced a noticeable drop in performance in 2012. However, CareTech’s leadership quickly addressed several challenges and has been rewarded for its efforts by once again taking the top spot in EITO. CareTech also received the top ranking for PITO, where they provide help desk services to clients of all sizes.

Cerner Is Making a Splash—Building on their success with application hosting, Cerner has quickly risen to be a strong performer in EITO, capturing second place in this category as well as having the most net new clients. Cerner is also offering other IT outsourcing options, showing up for the first time in PITO this year with the bulk of their work in AMS and making a showing in help desk.

Application Management and Help Desk Are the Hottest Areas for Those Outsourcing Discrete IT Functions—AMS growth has been driven in part by MU initiatives, where providers bring in a firm such as CSC, CTG, McKesson, Siemens, or Xerox to support their legacy applications so they can focus their staff on new clinical implementations. Siemens and Xerox have the highest marks in this area. CareTech and Dell Services have the most help desk engagements in this report, and CareTech and Xerox have the highest scores.

PITO Most Popular for Large Hospitals, and EITO Most Popular for Smaller Hospitals—Most IT outsourcing growth for large organizations (over 500 beds) are in tactical areas such as help desk, where Dell and CareTech are doing the most work; legacy application management, where CSC, CTG, McKesson, and Siemens are often used; and DCM, where Dell and Xerox are used the most. Of EITO engagements, 76% were for smaller providers (100–500 beds), who often have limited internal IT resources and difficulty attracting and retaining IT staff. Based on our sample, CareTech, McKesson, and Siemens have the most EITO engagements for organizations this size.

The Bottom Line on Vendors

CareTech Solutions: Top score. Provides only help desk in this sample. Quick service, consultant expertise, and partnership were client highlights. Some issues with turnover and support. No clients reducing or eliminating services, though one client is considering a move to EITO.

Cerner: Mostly AMS with one help desk client. Clients with AMS score Cerner higher. Overall, clients report that Cerner is a strong partner with knowledgeable, flexible resources. Smoother upgrades and proactive software management are also highlights. Some criticism of pricey service and green consultants.

CSC: Broad services capabilities. Two-thirds of clients are over 1,000 beds; providing AMS for most. Clients highlighted the quality of their ITO resources but some reported high cost, slow response, and lack of attention to small clients. Nearly half plan to eliminate due to going to a new HIS, end of a project, high cost, or lack of responsiveness from CSC.

CTG: Scored second overall for PITO. Provides primarily legacy application support in large hospitals as these clients move to new clinical/financial systems. Clients praise partnership, knowledge, and improved service. Scores highest in meeting timelines, communication, and problem resolution.

Dell: Offers wide range of IT outsourcing services; however, used most frequently for data center, help desk, and DMS. Praised for expertise and quality on-site resources. Nearly a third of clients are over 1,000 beds. Performance has trended downward the past two years. Some indicate Dell is slow to respond, misses timelines, and has weak issue resolution. A little over half of their clients in this study plan to reduce, replace, or eliminate services.

McKesson: Primarily provides AMS and help desk to clients of all sizes. Clients appreciate the level of executive involvement, helpful on-site resources, and the level of knowledge of their resources. Some complain of nickel-and-diming. Over 40% plan to reduce or eliminate PITO services due to conversion to a new clinical/financial system.

Siemens: Provides every PITO service this study measures, with the most engagements for AMS, help desk, and DCM. Above-average scores in AMS and DCM; praised for industry knowledge and professionalism. Scores declined slightly since 2011. Several clients expressed challenges with support due to moving off-peak support offshore, citing language barriers, missed timelines, and poor deliverables.

Xerox: Known commodity for DCM and provides help desk for many clients, which praise them for quick response and flexibility. Provides the most disaster recovery and security of any firm in this report. Turnover has some customers feeling annoyed and forgotten. Receives the highest score for quality of service staff and network management. Provides every PITO service.

CareTech: Ranked Best in KLAS in EITO from 2008 to 2011. Despite a drop in performance in 2012, they have addressed several client challenges and recaptured first place in this report. Praised for expertise and partnership. Highest scores for meeting timelines, providing quality staff, and high value-to-cost.

Cerner: Took a close second in report and regarded by clients as a great partner with good management in executives to trained on-site resources. The only complaints center on lack of responsiveness of Cerner’s help desk.

Dell: Reports of high-quality on-site resources. While some customers feel service suffered after Dell’s acquisition of Perot, recently several report Dell has been doing a good job refocusing and correcting problems. Dell’s scores have dropped due to issues getting knowledgeable resources in place quickly, weak follow-up, poor issue resolution, and confusion caused by the use of offshore resources.

McKesson: Providers report positive experiences with knowledgeable and trained staff who bring a level of structure, professionalism, and expertise. Some mention that McKesson is short-staffed, which negatively affects service, communication, and timelines. Several clients say price is high but value is also.

Siemens: Praised for quality of on-site staff, reliability, and results. Some feel moving support offshore has made customer service worse due to language barriers and time zone challenges. However, one customer mentioned recent improvements. In some cases, Siemens has had challenges sourcing the IT talent clients expected. Scored last in EITO.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.