2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Segments

Ambulatory EMR Usability 2013

More Nurture than Nature

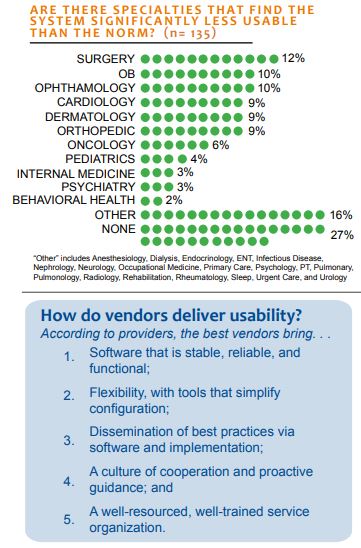

Aided by meaningful use (MU)incentive payments, many thousands of physicians are investing in electronic medical records (EMRs). The cost is high, but so are provider expectations. EMRs are often hailed as a key to improvements in productivity and clinical decisions, but critics say they are poorly designed and diminish physicians’ efficiency and effectiveness. Moreover, some say that MU certification requirements distract vendors from developing physician-friendly functionality. Which view of EMRs most closely matches reality? How inherently usable are vendors’ solutions? What elements contribute to high usability? What role do vendors and providers play in improving usability over time? KLAS interviewed 163 providers, targeting physician leadership at practices with more than 25 physicians, to share their perceptions.

Key Findings

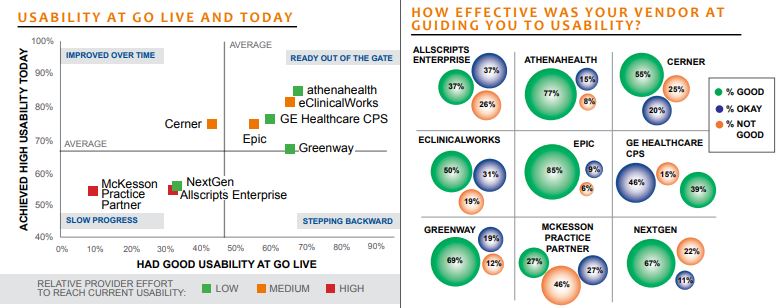

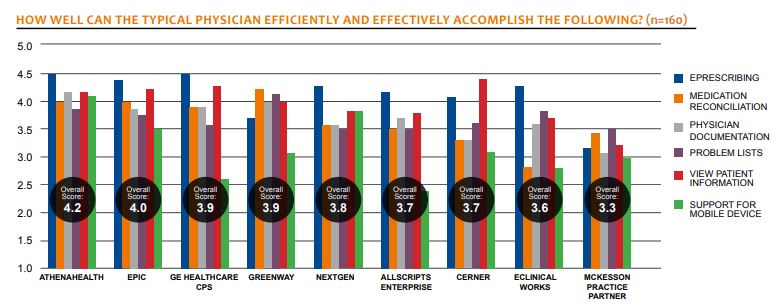

Wide Variations in Usability—and Pain: The percent reporting success in achieving high usability varies widely, from 85% among athenahealth clients to 55% for McKesson users. Only 8% of all respondents said they were unable to achieve at least moderate usability, but it doesn’t come natively. Many providers invested significant effort to get there, whether to compensate for product weaknesses or to optimize systems already ahead of the competition.

Vendor Guidance = Better Usability: One of the strongest indicators of EMR usability is how well vendors guide their clients. Although they serve very different client types, athenahealth and Epic received the highest usability ratings over six clinical areas. Epic offers a broad, integrated clinical suite for large enterprises while athenahealth markets an ambulatory SaaS solution for practices of all sizes, but both vendors share a common reputation for hand-holding and prescriptive, bestpractice implementations.

Poor Code Quality Impacts Usability: The best screen layouts and workflows cannot compensate for poor code quality. For Allscripts and McKesson customers, code-quality issues were usability show-stoppers. Both vendors had the smallest portions of customers who felt successful and the largest portions that invested extensive effort to make their systems usable.

Bottom Line On Vendors:

Allscripts Enterprise: Difficult upgrades distract both vendor and clients from usability goals. Extensive effort by clients improved usability, but fewer than three out of five feel successful. Help from Allscripts in short supply. Medication reconciliation and problem lists difficult for some. Clients optimistic about recent leadership change.

athenahealth: Most recent market entrant. Graded highest for usability at go live and current state. SaaS solution allows less modification than some would like yet tops usability ratings in most clinical functions, particularly physician documentation. Secondbest vendor for guiding clients.

Cerner: Recent development focus pays off: PowerChart now more robust and usable. Requires significant modification by clients, but Cerner seen as helpful partner. MPages lauded as flexible. Integration delivers familiar user experience in hospitals. Physician documentation with PowerNotes a weak spot.

eClinicalWorks: Often wins deals based on physicians’ initial impression. Secondhighest success rate for reaching high usability. Guidance less available for some clients who believe vendor is stretched thin by demand. Some screen layout complaints. “Rudimentary” medication reconciliation rated lowest among vendors.

Epic: Moderate to strong usability at go live, but most clients happy after adjustment period. Excels at guiding providers. Highly configurable and often customized, but model install gives clients head start. Rated above average in all functional areas. Longest time to proficiency for physicians. Largest physician practices in report data sample.

GE Healthcare CPS: Third-highest success rate for achieving high usability. Rated above average in all functional areas except problem lists. Physician documentation not highly adopted. Clients have long history with GE. Most say vendor did not play key role in guiding usability.

Greenway: Only vendor with no clients claiming poor usability at either go live or currently. Template library reduces need for provider modifications. Guidance from Greenway appreciated, but support not seen as proactive. Rates well in most functional areas, though ePrescribing painful until recent upgrade. Among smallest physician practices in report data sample.

McKesson Practice Partner: More than half of clients unhappy with go-live usability and most remain unsuccessful. Majority say overcoming poor code quality and weak support requires extensive effort by provider. Few praise McKesson for usability guidance. Rates below average in all functional areas with problem lists and medication reconciliation coming closest to average. Among smallest physician practices in report data sample.

NextGen: Go-live usability split between good, bad, and mediocre. Described as “blank slate” at go live by older clients, but newer clients getting a head start. With effort, providers moderately successful at improving usability. NextGen guidance helpful but reactive. Rates below average in most functional areas. Recent upgrades said to be more customizable and include larger template library.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.